Verticals

AI in Real Estate: From Startups to Enterprises, New Value Unlocked

Why this industry is ripe for AI disruption

Real estate is one of the largest asset classes in the world, yet many mid-market firms still rely on manual processes for marketing, operations, and property management. At the same time, a new wave of startups is moving into the space, building AI-driven solutions for valuation, tenant experience, and property marketing.

With abundant visual data (photos, floorplans, drone footage) and transactional records, the industry is rich in information that can be unlocked with AI. The momentum is undeniable: according to Forbes (2024), the AI in real estate market grew from $163 billion in 2022 to $226 billion in 2023 — an annual increase of more than 37%. While still a fraction of the $4 trillion global real estate services market, the pace of adoption signals a fundamental shift in how both established firms and emerging startups create and capture value.

Use Cases

Smarter Lead Qualification — AI models analyze complex patterns in user behavior and demographic data to identify individuals most likely to buy, sell, or rent. This reduces wasted effort and improves conversion.

Market Forecasting & Risk Assessment — Predictive AI uncovers patterns in market data and user behavior that human analysts often miss, giving investors more reliable insights for purchase and sale decisions.

Proactive Asset Management — Predictive maintenance, resource allocation, and performance monitoring reduce unexpected repair costs and improve tenant satisfaction, strengthening long-term value.

Enhanced Property Marketing & Tenant Experience — Generative AI can create photorealistic virtual staging, personalized interior design previews, and immersive 3D walkthroughs. This reduces time-to-market for listings, boosts buyer engagement, and allows prospects to envision properties without costly physical staging. Companies like InstanceDecoAI are already enabling real estate firms to turn raw photos into market-ready, visually appealing assets in hours instead of weeks.

Revolutionizing Property Valuation — AI-powered models integrate property features, market trends, and economic factors for more accurate valuations. Companies like CAPE Analytics have improved valuation accuracy by 7.7% while cutting manual inspections by 50%, streamlining investment and underwriting processes.

Challenges

Data Readiness — Photos, listings, and transaction data are often siloed, incomplete, or inconsistent, making it difficult to train reliable AI models. Without strong data governance, even the most advanced algorithms underperform.

Infrastructure Gaps — Many firms still rely on third-party SaaS tools rather than building AI-ready platforms. This limits flexibility, slows innovation, and creates dependence on vendors that may not evolve with the business.

Sector Maturity — The industry is still in its early stages of AI adoption. Roughly 45% of venture-backed companies in this space are in early development, and only 15% have reached late-stage funding. This immaturity means solutions can be fragmented, experimental, or unproven at scale.

Cultural & Organizational Barriers — In a traditionally conservative sector, AI is often viewed as a “luxury” rather than a necessity. Many mid-market firms lack in-house expertise to evaluate solutions or align them with long-term goals, leading to hesitation or stalled initiatives.

Execution Risk — Even when firms see promise, implementation is not plug-and-play. Success requires careful planning, integration of reliable data sources, interdisciplinary teams, and agility to adapt AI tools as markets shift. Without this foundation, adoption can stall, wasting both time and capital.

Infrastructure Angle

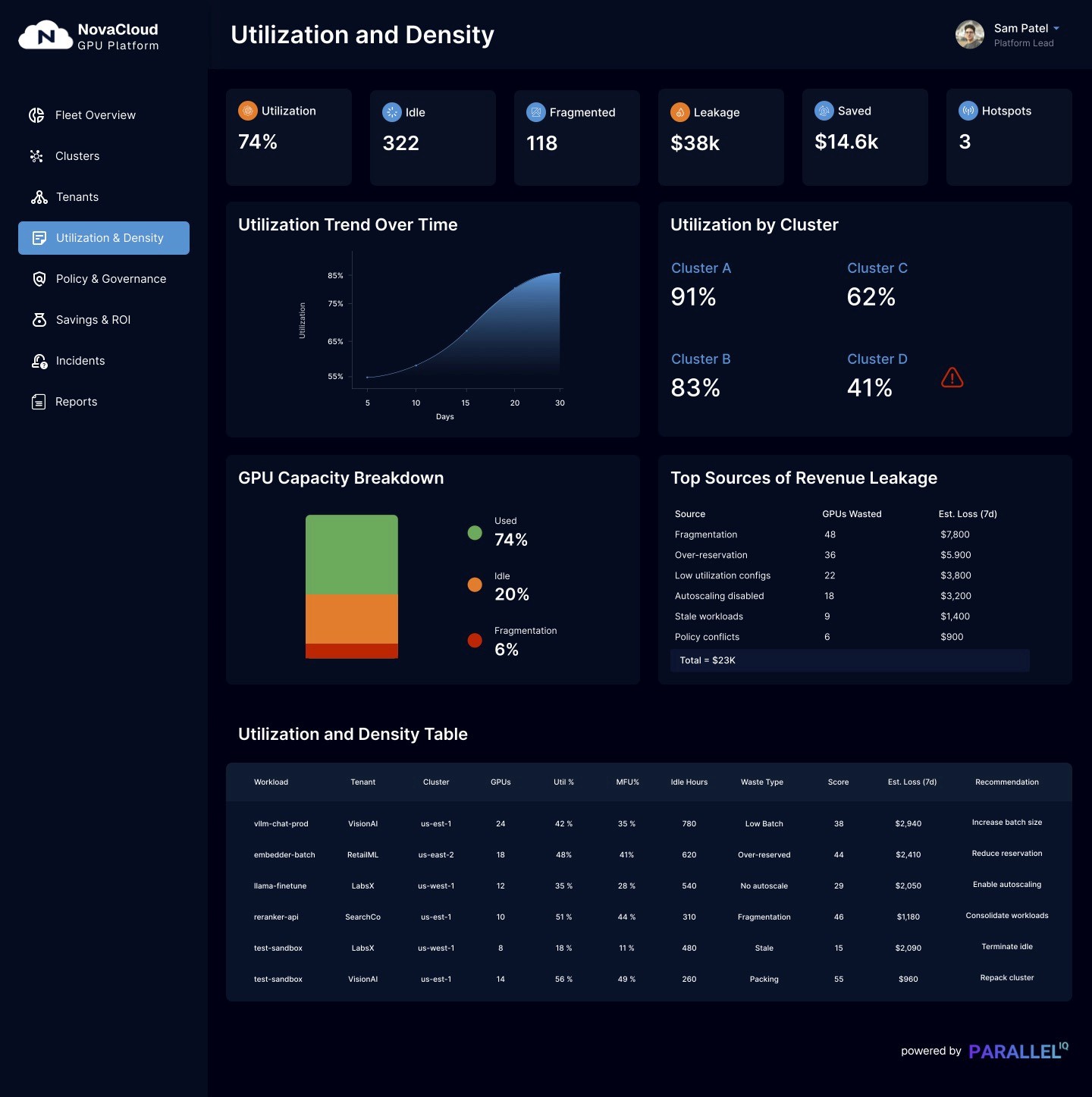

AI in real estate is only as strong as the infrastructure behind it. Today, most firms consume AI through SaaS platforms rather than hosting their own models — but those platforms themselves depend on reliable cloud clusters and robust observability. If a vendor’s training job fails mid-process or their inference service drifts without detection, it directly impacts the broker or investor relying on their outputs. By investing in strong infrastructure and transparent observability, SaaS providers can deliver the reliability that real estate companies expect. And for the firms consuming these solutions, choosing partners with a solid foundation ensures AI results are not just impressive demos but dependable tools in daily operations.

Key Takeaway

AI in real estate isn’t just hype — it’s already reshaping how properties are marketed, managed, and valued. Mid-market firms are adopting AI to streamline operations and cut costs, while startups are entering the space with innovative tools that reimagine the tenant and buyer experience.

What unites them is the need for strong infrastructure. With the right foundation — observability, scalability, and cost control — AI becomes not only practical but profitable, driving faster deals, smarter decisions, and more engaging customer journeys across the industry.

Closing: Building AI-Ready Infrastructure for Sustainable ROI

AI is unlocking new opportunities in real estate — from mid-market firms modernizing operations to startups building the next generation of AI solutions. But without strong infrastructure, those opportunities risk slipping away. At ParallelIQ, we help growth-stage startups and mid-market companies alike close this execution gap — building the observability, scheduling, and efficiency foundations they need to scale AI without waste.

Audit your workloads. Measure GPU idle time. Invest in monitoring. That’s how you avoid the execution gap.

👉 Want to learn how observability can accelerate your AI execution?

[Schedule a call to discuss → here]