Cloud Providers and Infrastructure

Hyperscaler Credits: Friend, Trap… or Both?

Introduction

For most startups, hyperscaler credits feel like a gift from heaven. Suddenly, you’ve got thousands — sometimes millions — of dollars in cloud resources at your fingertips. GPUs spin up in minutes, pipelines scale effortlessly, and the burn rate seems under control. It feels like free fuel for takeoff.

But credits can also create blind spots. When infrastructure feels “free,” efficiency takes a back seat. Idle GPUs don’t feel painful, overprovisioning slips by unnoticed, and observability rarely makes the roadmap. Then the day arrives when credits expire — and what once felt like a lifeline turns into a cost crunch.

So are credits a friend or a trap? The truth is, they’re both. Used strategically, credits buy you speed, iteration, and early investor confidence. Misused, they set habits that erode runway, lock you into expensive infrastructure, and slow progress at the worst possible moment.

In this article, we’ll break down how to make credits work for you — and how to avoid the traps that sink too many Series B/C startups.

The Allure of Credits (Friend)

For early-stage startups, hyperscaler credits feel like a superpower. Instead of worrying about racking up a six-figure cloud bill in the first year, you get breathing room. Credits reduce burn in those critical early months, letting founders focus on product, users, and fundraising — not invoices.

They also make experimentation faster. Need to spin up a 32-GPU training cluster to test a new model? With credits, you can. Hyperscaler ecosystems provide instant access to managed databases, CI/CD pipelines, observability tools, and APIs — all the building blocks you’d never have the time or team to assemble yourself.

And credits don’t just help on the technical side. They also help founders tell a story. To investors, saying “we’re running on AWS/GCP/Azure” signals scale-ready infrastructure and lowers perceived risk. For Seed → Series A companies, credits often mean the difference between limping along on limited hardware and moving fast enough to prove traction.

In short: credits are a friend. They provide speed, optionality, and narrative strength at the stage when startups need them most. The problem is what happens when that safety net disappears.

The Hidden Costs (Trap)

Credits are powerful, but they also create dangerous blind spots. When infrastructure feels free, efficiency becomes an afterthought. Teams spin up oversized clusters “just in case,” leave jobs running overnight, or skip monitoring because there’s no immediate financial sting. Idle GPUs don’t feel expensive — until credits run out and the bill comes due.

This leads to overprovisioning and a lack of observability. Why invest in dashboards, utilization metrics, or right-sizing policies when the meter isn’t ticking? The problem is that habits formed during the “free” phase carry forward. By the time a startup reaches Series B or C, those habits translate into bloated infrastructure, slow iteration cycles, and spiraling costs.

Another trap is lock-in. Hyperscalers make it easy to integrate their managed services while credits are flowing — data lakes, CI/CD pipelines, monitoring tools, even proprietary APIs. But when the credits dry up, migrating to a leaner stack or a bare-metal provider is harder than it looks. The very infra you built to move fast early can become the anchor that drags your burn rate higher later.

For growth-stage startups, the result is a painful paradox: the same credits that accelerated takeoff can also set the stage for a cost crunch. The “credit cliff” doesn’t just hit budgets — it slows learning, delays milestones, and risks survival at the point where momentum matters most.

Beyond Credits: Building Discipline Early

The best way to avoid the credit cliff is to build good habits before it hits. Efficiency during credits isn’t just about saving money later — it extends runway now. Every dollar of credit you burn efficiently is a dollar you don’t need to replace with equity or cash once credits expire.

Here are four practices startups can adopt early:

➤ Observability

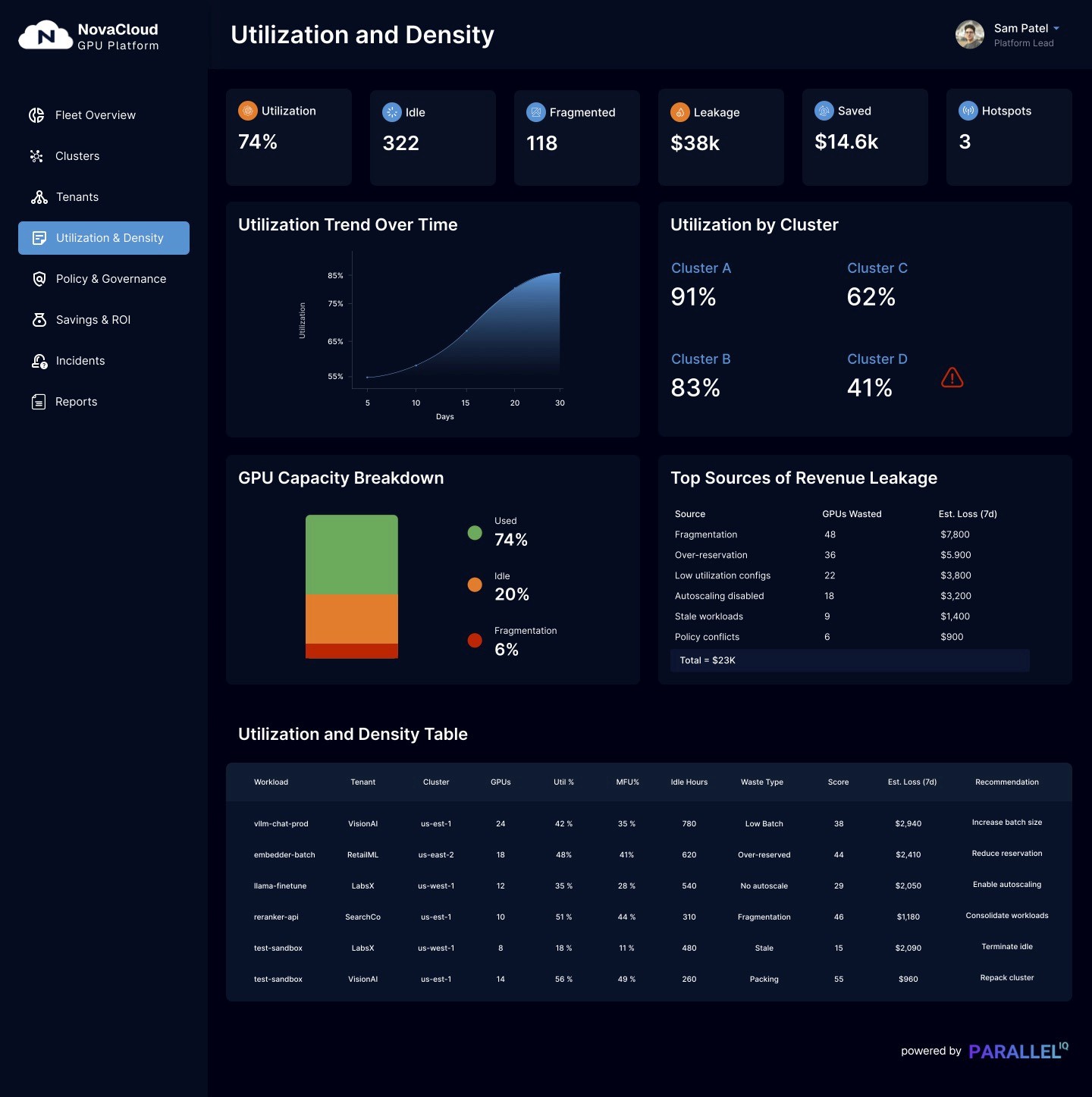

Even if compute feels free, wasted cycles still cost time and talent. A stalled training job might not show up on the balance sheet today, but it means fewer experiments and slower iteration. By putting observability in place during the credit phase — GPU utilization dashboards, job-level monitoring, alerts on idle clusters — you establish the feedback loops that keep your team moving fast.

➤ Right-Sizing & Autoscaling

It’s tempting to request “the biggest cluster possible” when credits are paying the bill. But workloads rarely need that much. Right-sizing node pools and implementing autoscaling policies ensure that resource allocation matches real training demand. One Series B startup that adopted this discipline cut AI training costs by 40% without any performance trade-off — a practice that would have extended their credits by months if applied earlier.

➤ Hybrid Strategies

Hyperscalers make it easy to go all-in, but that’s exactly how startups get locked in. Instead, design for hybrid. Keep managed services where they add clear value — CI/CD, databases, compliance tooling — but shift heavy GPU training to VPS or bare-metal providers where costs are 3–5× lower. By experimenting with hybrid setups during the credit phase, you avoid a painful all-at-once migration later.

➤ Think Compliance Early

It’s easy to push compliance to “later” when you’re racing for product-market fit. But rebuilding infrastructure under regulatory pressure can cost more time and money than building it right the first time. Observability, traceability, and policy-as-code practices don’t just prepare you for audits — they also reduce risk and make your platform more attractive to enterprise customers.

The bottom line: Credits aren’t an excuse to ignore efficiency. They’re the perfect time to build discipline — because the habits you form now determine whether your startup’s infrastructure scales with you or stalls you.

Case Snippets (Proof)

The risks of credit-driven inefficiency aren’t hypothetical — we’ve seen them play out firsthand. A few examples from our work:

40% Savings Post-Credits

A growth-stage startup cut training costs by 40% when they shifted large jobs off hyperscalers and onto bare-metal GPUs after their credits expired. The key insight: those same savings could have been captured earlier, extending their credits by months instead of burning through them at hyperscaler rates.85% Lower Drift Detection Costs

Another startup added observability into their ML pipelines and discovered redundant retraining cycles driving up GPU usage. By fixing this, they reduced drift detection costs by 85%. If these practices had been in place during the credit phase, every dollar of credits would have delivered more experiments instead of more waste.

The lesson is clear: credits can hide inefficiency, but they don’t erase it. Building discipline early means credits last longer — and when they do run out, you avoid a painful cost cliff.

Key Takeaway / CTA

Hyperscaler credits are both a friend and a trap. They fuel early growth, but they also mask inefficiencies, encourage bad habits, and lock startups into expensive infrastructure.

The real win isn’t choosing sides — it’s using credits strategically while building the efficiency and portability to thrive once they’re gone.

At ParallelIQ, we help startups:

➤ Extend credits by cutting hidden GPU waste

➤ Build observability so stalls are caught before they burn runway

➤ Design hybrid strategies that keep costs low without slowing iteration

👉 Credits don’t guarantee runway — efficiency does. Let’s make every GPU cycle count.

ParallelIQ: Making AI Infrastructure Work for Startups

At ParallelIQ, we’ve seen the “credit cliff” play out too many times. Startups build amazing models and pipelines, only to lose momentum when infrastructure costs spike and credits run out. Our mission is simple: help growth-stage startups scale AI without wasting runway.

We partner with teams to:

🔍 Audit workloads and expose hidden GPU waste

📊 Build observability to catch stalls before they burn cycles

⚙️ Right-size clusters and apply autoscaling for true efficiency

🌐 Design hybrid strategies that balance hyperscaler services with bare-metal cost savings

Whether you’re still riding on credits or already feeling the crunch, ParallelIQ helps you extend runway, accelerate iteration, and scale with confidence.

👉 Ready to make every GPU cycle count? Let’s talk.Schedule a call / Contact us -> here

#AIInfrastructure #GPUs #BareMetal #CloudComputing #ParallelIQ