Cloud Providers and Infrastructure

Inside the Infrastructure War: Hyperscalers vs. VPS in the AI Gold Rush

Introduction

AI startups today are locked in a compute arms race. The pace of innovation isn’t limited by ideas, but by access to GPUs — the new gold in the AI economy.

On one side are the hyperscalers — AWS, Google Cloud, and Azure — offering rich ecosystems, managed services, and often tens of thousands of dollars in free credits for early-stage startups. Their pitch is simple: build fast, scale seamlessly, and don’t worry about the plumbing.

On the other side are the bare metal and VPS providers — leaner players like CoreWeave, Lambda, Runpod and others — who strip away the layers of cloud abstraction and offer direct access to raw GPU power at a fraction of the cost. For cash-conscious startups, every dollar saved on compute is another month of runway.

The choice isn’t academic. It shapes how quickly you can train models, how long your credits last, how much you burn each month, and how easily you can pivot. For early-stage founders, this is less about IT infrastructure and more about survival strategy.

👉 The battle for GPU dominance isn’t just about hardware — it’s about business models, speed, and survival.

The Hyperscaler Advantage

For early-stage startups, hyperscalers are hard to ignore. They offer an on-ramp to AI development that feels almost frictionless.

💰 Free Credits — Fuel for Early Adoption

Most hyperscalers dangle substantial credits, often tiered by funding stage:

Pre-seed/Seed: $10k–$25k in credits, enough to test ideas and run small-scale pilots.

Series A/B: $100k+ in credits, often bundled with technical support and introductions to ecosystem partners.

These credits give founders a chance to train real models without draining their bank account — a tempting offer when time-to-market is critical.

⚙️ Managed Ecosystem — Build Fast Without Plumbing

With storage, data pipelines, model registries, compliance tooling, and monitoring already built in, hyperscalers remove much of the operational overhead. Startups can focus on shipping features instead of wrestling with infrastructure.

🌍 Global Reach — Scale Instantly

Hyperscalers offer global footprints with multi-region deployments, redundancy, and security certifications that would take years to replicate on your own. For startups chasing customers across geographies, this matters.

⚠️ The Catch — The Bill Always Comes

Once credits run out, costs skyrocket. A single H100 instance on a hyperscaler can cost several times what it would on a bare metal provider.

Vendor lock-in becomes real: applications built tightly around a hyperscaler’s managed services are harder to move.

GPU availability constraints mean that even with credits, you may not get the capacity you need, when you need it.

👉 Hyperscalers make a fantastic launchpad — but they often turn into a gilded cage once the free ride ends.

The Bare Metal / VPS Advantage

For startups watching every dollar of runway, bare metal and VPS providers look like a lifeline. They strip away the cloud premium and offer what many founders really want: raw GPU capacity at a predictable price.

💵 Lower Costs per GPU Hour — Stretching Runway

Where a hyperscaler might charge $4–$5/hour for an H100, a bare metal provider could come in at half that cost — or less. For a startup training large models or running continuous experiments, this translates into months of extra runway. Every saved dollar buys more iterations, more features, and more chances to hit product-market fit. The chart below illustrates that as GPU counts scale from 10 to 1,000, total costs rise sharply on hyperscalers, while bare metal grows at a more gradual pace.

🖥️ Direct Control — No Layers of Abstraction

On bare metal, the GPU is yours. There’s no managed service layer dictating how you run jobs or abstracting away performance details. Engineers get full access to the hardware, drivers, and networking stack — a huge advantage for teams that want to fine-tune performance or squeeze every ounce of efficiency from their infrastructure.

🔧 Flexibility — Build Your Own Stack

Instead of being nudged toward a hyperscaler’s database, storage, or ML service, startups can pick the exact tools and frameworks that work for them. Want to run Slurm, Ray, or Kubernetes your way? You can. This freedom avoids vendor lock-in and creates room for hybrid setups later.

⚠️ The Catch — DIY Comes at a Cost

Less managed tooling: You don’t get ready-made monitoring, compliance, or pipeline services. Teams must build or integrate these themselves.

Scaling pains: Going from 8 GPUs to 800 is non-trivial without the elastic scaling of a hyperscaler.

Operational overhead: Someone has to manage drivers, networking, storage, and uptime — and for lean startups, that’s often the CTO at 2 a.m.

👉 Bare metal isn’t the polished on-ramp that hyperscalers provide. But for teams willing to do more of the heavy lifting, it’s the cheaper, faster lane to raw capacity.

The Startup Journey

The choice between hyperscalers and bare metal isn’t static — it evolves as a startup grows. Each stage of the journey brings new pressures, and with them, different infrastructure priorities.

🌱 Early Stage (Seed / Pre-Series A) — Credits Are Irresistible

At the very beginning, capital is scarce and time-to-market is everything. Hyperscaler credits — $10k, $50k, sometimes $100k+ — look like free fuel. Founders can prototype, train early models, and demo to investors without worrying about a bill. Convenience trumps efficiency at this stage.

📈 Growth Stage (Series A–B) — Burn Rate Bites

Once traction arrives, workloads multiply. Training runs go from hours to days, datasets expand, and inference begins to scale with users. Suddenly those free credits are gone — and the cloud bill rivals payroll. This is when many startups migrate heavy training workloads to bare metal or VPS providers to stretch cash. Runway is more valuable than convenience, and cost per GPU hour becomes the north star.

🏢 Mature Stage — The Hybrid Reality

As startups mature, they can no longer rely solely on either option. Hybrid strategies emerge:

Hyperscalers for managed services, global reach, and compliance.

Bare metal for core training jobs where cost efficiency matters most.

This stage is about balancing performance with governance, and building an infrastructure mix that scales sustainably.

👉 Startups start in the cloud for speed, move to bare metal for cost, and eventually settle into a hybrid balance of both worlds.

The Economics of War

At the heart of the hyperscaler vs. bare metal debate is a simple question: what does a GPU hour really cost — and what do you get for it?

💵 Real-World Cost Comparison

On a hyperscaler, renting a single NVIDIA H100 might cost $4–$5 per GPU hour.

On a bare metal or VPS provider, the same GPU could run $2–$3 per hour — sometimes less with reserved capacity.

That gap adds up fast. A 512-GPU training run that costs $250k in the cloud might be under $125k on bare metal.

⚖️ The Tradeoff — Convenience vs. Efficiency

Hyperscalers wrap those extra dollars in managed services, compliance, and instant scale. Bare metal strips away the extras and delivers raw performance at lower cost. The tradeoff is clear: do you want someone else to manage the complexity, or do you want the efficiency (and control) of building it yourself?

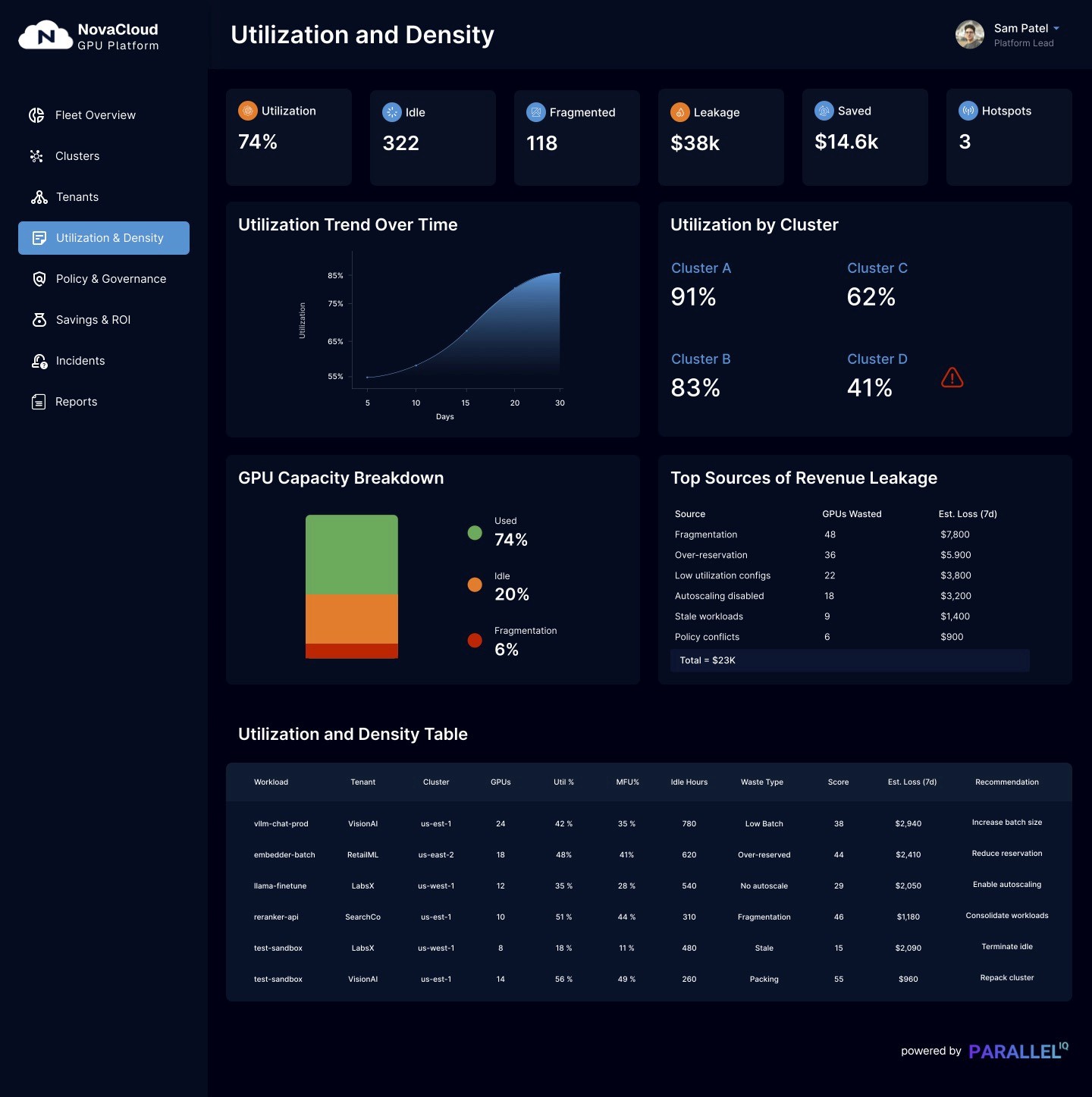

🔍 The Hidden Equalizer — Observability & Workload Management

This is where the conversation shifts. No matter which path you choose, without observability and intelligent workload management, inefficiencies creep in:

Idle GPUs burning credits.

Training jobs stalling due to poor scheduling.

Drift and re-training cycles wasting compute.

The companies that win aren’t just the ones that pick the right provider — they’re the ones that see, measure, and optimize every GPU cycle. Observability becomes the factory inspector in the AI war, ensuring no resource is wasted.

👉 The economics of this war are not just about sticker price. They’re about how efficiently you turn every GPU hour into business value.

The Future Outlook

The GPU war isn’t ending anytime soon. If anything, it’s intensifying — with both sides doubling down on their strengths.

☁️ Hyperscalers Double Down on Platforms

Expect AWS, Google Cloud, and Azure to keep leaning into managed AI platforms — Vertex AI, Bedrock, Azure AI Studio — bundled tightly with credits to lock startups in early. Their pitch will go beyond raw compute: “Why manage GPUs when you can have an end-to-end AI stack, from data prep to deployment, under one roof?” For regulated industries or global enterprises, this is an irresistible value proposition.

🖥️ Bare Metal & VPS Providers Scale Up

Meanwhile, CoreWeave, Lambda, Vast.ai, and others are scaling infrastructure at breakneck speed. Their focus: availability, price transparency, and raw performance. Instead of wrapping customers in ecosystem glue, they compete on cost-per-GPU-hour and the promise of “What you see is what you get.” For startups chasing runway, that’s a compelling counter-offer.

🔗 The Likely Outcome — Hybrid Dominance

In the long run, most companies won’t live in just one camp. The winning strategy is likely hybrid:

Bare metal for cost-sensitive, GPU-hungry training jobs.

Hyperscalers for compliance-heavy workloads, managed services, and global reach.

This mirrors the broader evolution of enterprise IT: hybrid cloud became the norm, and now hybrid AI infrastructure will too.

👉 The future isn’t about choosing sides in the GPU war — it’s about building the right mix for your stage, your industry, and your growth path.

Closing / Call-to-Action

The battle between hyperscalers and bare metal isn’t just about infrastructure — it’s about survival, growth, and long-term strategy. Startups that treat GPU access as a commodity risk getting trapped in runaway costs or capacity shortages. Those that treat it as a strategic resource can turn compute into a true competitive edge.

At ParallelIQ, we help companies cut through the noise. Whether you’re stretching seed-stage credits, scaling workloads post-Series A, or designing a hybrid infrastructure at maturity, we bring the tools and expertise to:

🔍 Audit workloads to eliminate waste and idle GPUs.

📊 Build observability into your pipelines for cost and performance clarity.

⚡ Design hybrid strategies that balance bare metal efficiency with hyperscaler scale.

👉 The GPU war isn’t about choosing a side — it’s about choosing smart. Let’s talk about how to build an AI infrastructure that scales with your business, not against it.

#AIInfrastructure #GPUs #BareMetal #CloudComputing #ParallelIQ