Cloud Providers and Infrastructure

AI-Native Startups vs. Mid-Market Incumbents: Who Wins the Race?

Intro Story: The AI Wake-Up Call

Startup A bursts onto the scene with an AI-native SaaS — think virtual tours that adapt in real time for real estate buyers. It’s sleek, fast, and customers love it.

Meanwhile, Mid-market Company B has offered virtual tours for years, but without AI. Overnight, its offering feels dated. Suddenly, B is faced with a painful choice: adopt its competitor’s AI SaaS just to stay relevant, or build AI capabilities in-house to compete.

This is the new reality for mid-market firms. AI isn’t just a feature anymore — it’s a foundation. And the question isn’t if you’ll need it, but whether your data, infrastructure, and teams are ready to execute.

The Advantage of Being Born AI-Native

Startup A had one massive advantage: it was born AI-native. From day one, its data pipelines were built cleanly, its infrastructure was designed for AI workloads, and its team was stacked with AI talent. There were no legacy systems to rewire, no fragmented databases to reconcile — everything was optimized for speed and scale.

That foundation translated into a faster pace of innovation. The team could iterate rapidly, test new features, and bring them to market in weeks, not months. Each release made the product smarter and more attractive, widening the gap between the startup and incumbents.

And critically, its go-to-market strategy was SaaS-first. That meant Startup A didn’t just compete with mid-market Company B — it could also sell directly to B’s peers or even to B itself. What started as a feature advantage quickly became an existential threat to incumbents without AI in their stack.

The Mid-Market Challenge

For many mid-market firms, the barriers to AI adoption are as much organizational as they are technical.

Legacy processes and fragmented data make it difficult to build clean pipelines. Information often lives across multiple applications and formats, with no unified flow into AI-ready systems.

Limited in-house AI expertise means companies lack the talent to design, deploy, and maintain AI infrastructure. Recruiting is competitive, and many firms can’t afford to wait months for new hires to ramp up.

Cultural inertia often frames AI as “nice-to-have” rather than essential. Teams are comfortable with existing workflows and skeptical of disruption, even as the competitive gap widens.

Pressure to deliver forces many firms to adopt external SaaS solutions from startups as a quick fix. While this can close short-term gaps, it risks long-term dependency and a loss of control over data and differentiation.

The result is a paradox: mid-market firms see the value of AI but are constrained by execution gaps that make it difficult to realize that value on their own.

The Strategic Dilemma

Mid-market leaders face a difficult choice.

Short-term: Adopting a competitor’s SaaS keeps services alive and buys time. Customers get the AI-driven features they now expect, and the business avoids immediate churn.

Long-term: That same move creates dependency on an external vendor. Margins shrink as licensing costs mount, differentiation erodes, and the company risks becoming just another reseller of someone else’s innovation.

This is the AI Execution Gap in action. Leaders know AI matters, but without the right infrastructure and practices in-house, they struggle to execute — forced into reactive decisions that trade control today for survival tomorrow.

Industry Implications

Across every sector, we’ll see more AI-native SaaS startups positioning themselves to serve entire verticals — real estate, healthcare, finance, logistics, and beyond. Their clean pipelines and cloud-first infrastructure let them scale quickly and win market share.

For mid-market firms, the risk is clear: without investment in data readiness and infrastructure, they risk being locked into competitors’ ecosystems, paying recurring fees for someone else’s innovation while losing control of their customer experience.

The winners will be the firms that close the AI Execution Gap — building their own AI-ready foundations. These are the companies that will thrive, not just survive, in an AI-driven market.

Closing Thought / Call-Forward

The real question for mid-market incumbents is this:

Will you choose the short-term safety of adopting someone else’s SaaS, or make the harder investments to build your own AI muscle?

The winners of the next decade will be defined by that choice.

This article is just the start. In future posts, we’ll unpack what “building AI muscle” really looks like — from modernizing infrastructure to closing data gaps to embedding observability at every layer.

Where ParallelIQ Fits In

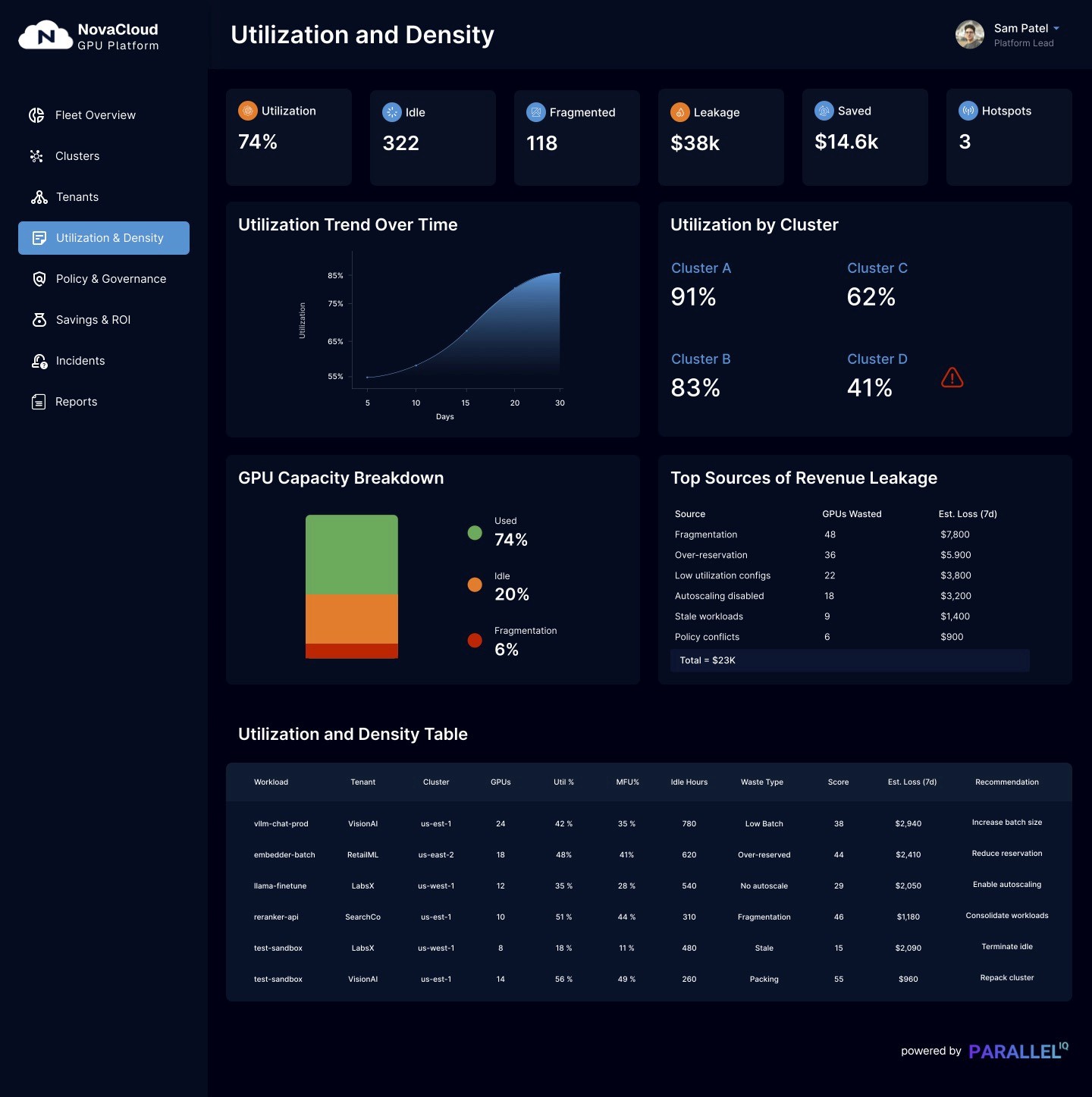

At ParallelIQ, we help mid-market companies cut GPU waste, build observability into their pipelines, and modernize infrastructure — so they can move as fast as AI-native competitors without losing control of their business.

👉 Want to learn how to cut GPU waste, embed observability, and modernize your AI infrastructure? Let’s talk about how to close the AI Execution Gap. [Schedule a call to discuss → here]